What is day and swing trading?

Swing trading vs. day trading: key differences

Factors to consider when choosing between day trading and swing trading

Swing trading vs day trading: which is riskier?

Swing trading vs day trading: which is more profitable?

One aspect of any trading strategy is the time spent on holding trades. Therefore, traders like to categorise themselves into either of the two broad styles of trading: day trading or swing trading. Learn the key differences between swing trading and day trading to discover which type is best suited for you.

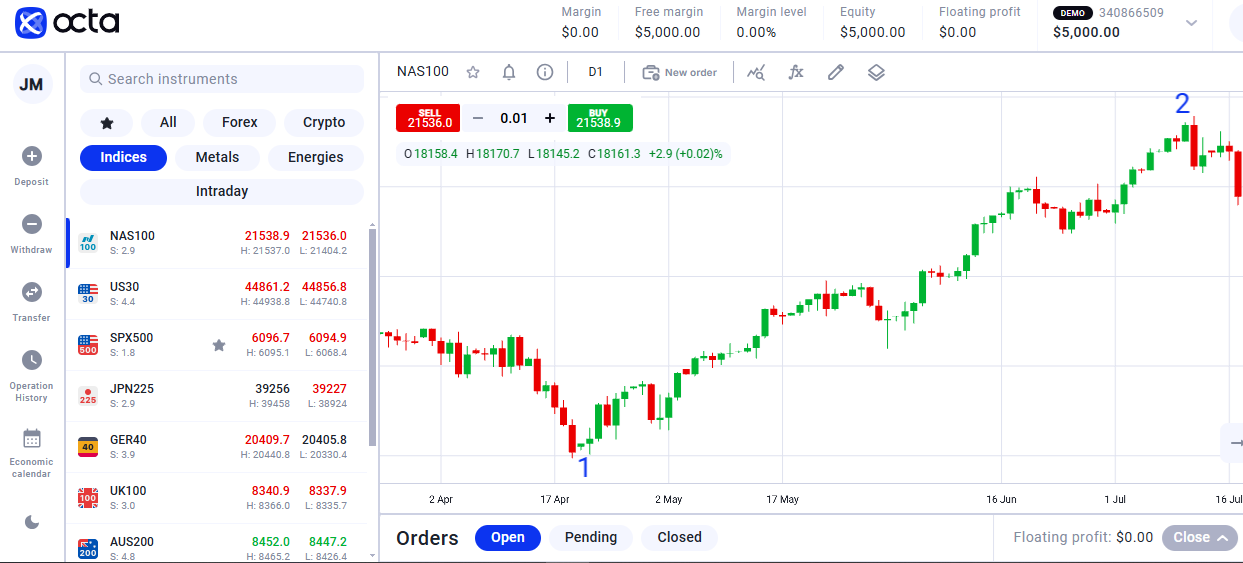

Swing trading is a style of Forex trading that involves holding trades for several days or weeks. In the NAS100 chart below, holding the buy position from Point 1 to Point 2 represents an instance of swing trading. The swing trade ran for several months, from April till July.What is day and swing trading?

Swing trading

Compared to day traders, swing traders can successfully navigate short-term price movements and use price momentum in their favour. They emphasise trends and external dynamics affecting prices rather than focusing on the asset's intrinsic value.

Swing trading advantages:

It requires less time. With swing trading, traders don't need to monitor the market and make quick forecasts constantly. In general, swing traders check positions once or twice per day. This implies that one can do swing trading alongside one's full-time job.

It can be more profitable. When the trader knows how to identify a buying or selling position near the peak, they will enjoy a massive price movement in their favour, thus maximising profits.

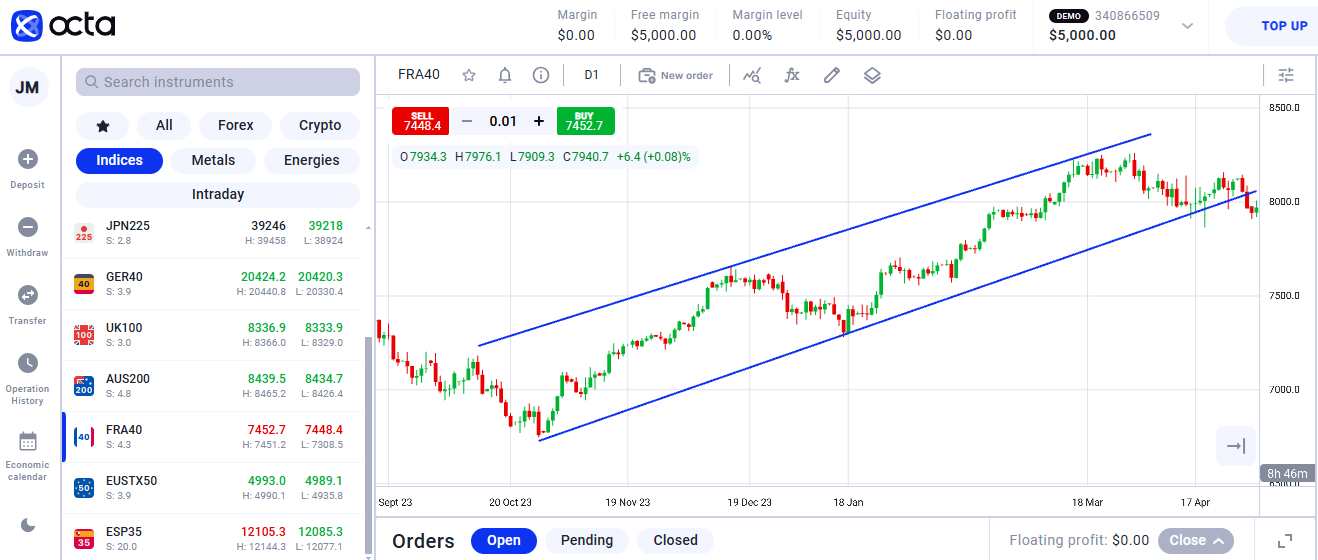

In the example above, a significant profit was realised from the FRA40 buy swing trade. Besides, traders spend less on spreads or potential commissions as trades are done less frequently.

Swing trading disadvantages:

High capital requirements. To swing trade, the trader requires a higher margin due to fluctuations. Thus, the higher the profit targets the higher the margin.

It may involve overnight commissions and swaps. While Octa does not charge overnight fees called swaps, other brokers may charge them for holding trades overnight. Although some currencies may have positive swaps, in case there would be negative swaps and the trade fails to move, they may draw down the account.

It's less predictable. As swing trading implies longer-term forecasts, it can be challenging to determine the most suitable price to enter and exit trades.

To sum up:

| Advantages | Disadvantages |

| Less time-consuming | Overnight fees with some brokers (but not with Octa) |

| Higher profit potential | Less predictability |

Day trading

1. Sell

2. Buy

This is another Forex trading style that limits itself to a particular trading day and not more than that. Day traders open and close their positions on the same day. They can also opt for multiple transactions on the same asset within a day. This way, they are able to close all trades before the end of the trading day and do not hold any open positions overnight. Price volatility and average day range are two key factors impacting the day traders' effectiveness. They are experts in entering and exiting trades quickly and efficiently to secure profits from the trading activity.

Advantages of day trading compared to swing trading:

It may brings quicker returns. As day trading is about earning from small price movements during a single day, it allows a trader to earn less but quickly, given that he has enough knowledge and uses risk management.

There is no overnight risk. Traders close all their positions by the end of the day, so they don't face an overnight price change due to news or events.

Disadvantages of day trading compared to swing trading:

It takes a lot of time. To succeed at day trading, a trader needs to monitor the market throughout the day. This makes day trading more like a full-time job rather than an opportunity for some extra earnings.

It might bring more stress. Day trading involves making quick decisions and implies quick potential losses along with profits, which can be rather stressful for traders.

To sum up:

| Advantages | Disadvantages |

| Quicker potential profits | Time-consuming |

| No overnight risk | More stressful |

The table below shows some key differences between swing trading and day trading.Swing trading vs. day trading: key differences

Time for holding trades

Day trading involves opening and closing all positions before the end of the day. The traders do not roll over the trades overnight.

Swing trading involves medium- to long-term trades. Traders hold their open positions for extended periods, from days to weeks.

Timeframes used by traders

Since day trading involves high-frequency trades, the traders usually analyse the market on lower timeframes, such as 1-hour and 15-minute ones. Some traders even prefer 5- minute frames for entries and exits.

In swing trading, traders use higher timeframes to analyse weekly and daily trades. These traders prefer to enter positions on a 4- hour timeframe.

Indicators and tools used by traders

In day trading, the traders use lower moving averages, such as 20-day moving averages. Other technical indicators include support and resistance zones, price action, and candlestick patterns.

For swing trading, traders mainly use higher moving averages, such as the 200-day average. These types of traders also use demand and supply zones, support and resistance zones, Fibonacci retracement, and trend lines.

Commitment

Day trading demands a high level of commitment. It is like a full-time job since traders monitor the daily trades on the trading software.

In swing trading, traders have a lot of time at their disposal since they monitor traders once or twice a day. Therefore, traders can do Forex trading as a part-time job.

As we have discussed earlier, day trading involves closing all traders before the end of the day. On the other hand, swing trading is a trading style that involves medium- to long-term trading. In swing trading, the traders can hold traders from a few days to sometimes months. As day trading involves closing multiple positions during the day, it does not imply that it is more profitable than swing trading. Profit depends mostly on having a consistent strategy and risk management. Deciding which trading style is best depends on aspects like account size, time available to monitor trades, risk appetite, and trading plan. Thus, traders must consider risk management, regardless of their trading style. Without proper risk management, any trading style can lead to significant losses.Factors to consider when choosing between day trading and swing trading

In short, both. Although swing trading involves more considerable sums and price fluctuations, day trading is still considered riskier. It involves many trades within a day, which implies more immediate risks and chances of losing money. While it allows you to earn quickly, it can also result in quick losses. Swing trading is also risky. However, it involves much fewer trades—one trade every several days or weeks—which allows for better analysis and more informed decisions.Swing trading vs day trading: which is riskier?

Overall, both styles can bring significant profit to successful traders. They are frequently used with different free resources. However, swing trading can be more profitable because traders can increase lot size and add more leverage to positions during retracements since the running trades provide a buffer. For example:Swing trading vs day trading: which is more profitable?

In a swing trade from point 1 to point 2, the trader is able to add more positions (increase contracts used) on retracements as indicated by the arrow, while still holding the first position taken.

Final thoughts