Back

15 Jun 2023

Crude Oil Futures: Further rebound in the pipeline

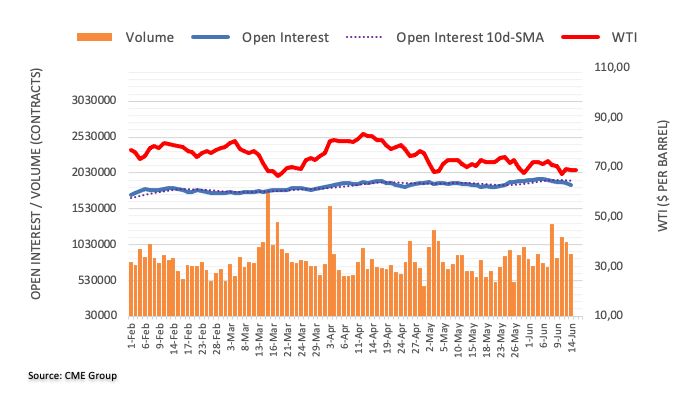

CME Group’s flash data for crude oil futures markets saw traders scale back their open interest positions by more than 21K contracts on Wednesday, adding to the previous daily drop. In the same line, volume went down for the second session in a row, this time by around 164.3K contracts.

WTI: Upside remains capped near $75.00

Wednesday’s daily retracement in prices of WTI was accompanied by diminishing open interest and volume, hinting at the idea that further weakness is not favoured and opening the door at the same time to a probable bounce in the short-term horizon. Against that, bullish moves are expected to meet a decent barrier around the monthly peak near the $75.00 mark per barrel (June 5).